Renters Insurance in and around Gillette

Your renters insurance search is over, Gillette

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a townhome or an apartment, protection for your personal belongings is a good idea, especially if you own items that would be difficult to fix or replace.

Your renters insurance search is over, Gillette

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented home include a wide variety of things like your set of favorite books, video game system, cooking set, and more. That's why renters insurance can be such a good choice. But don't worry, State Farm agent Ida Snead has the personal attention and dedication needed to help you evaluate your risks and help you keep your belongings protected.

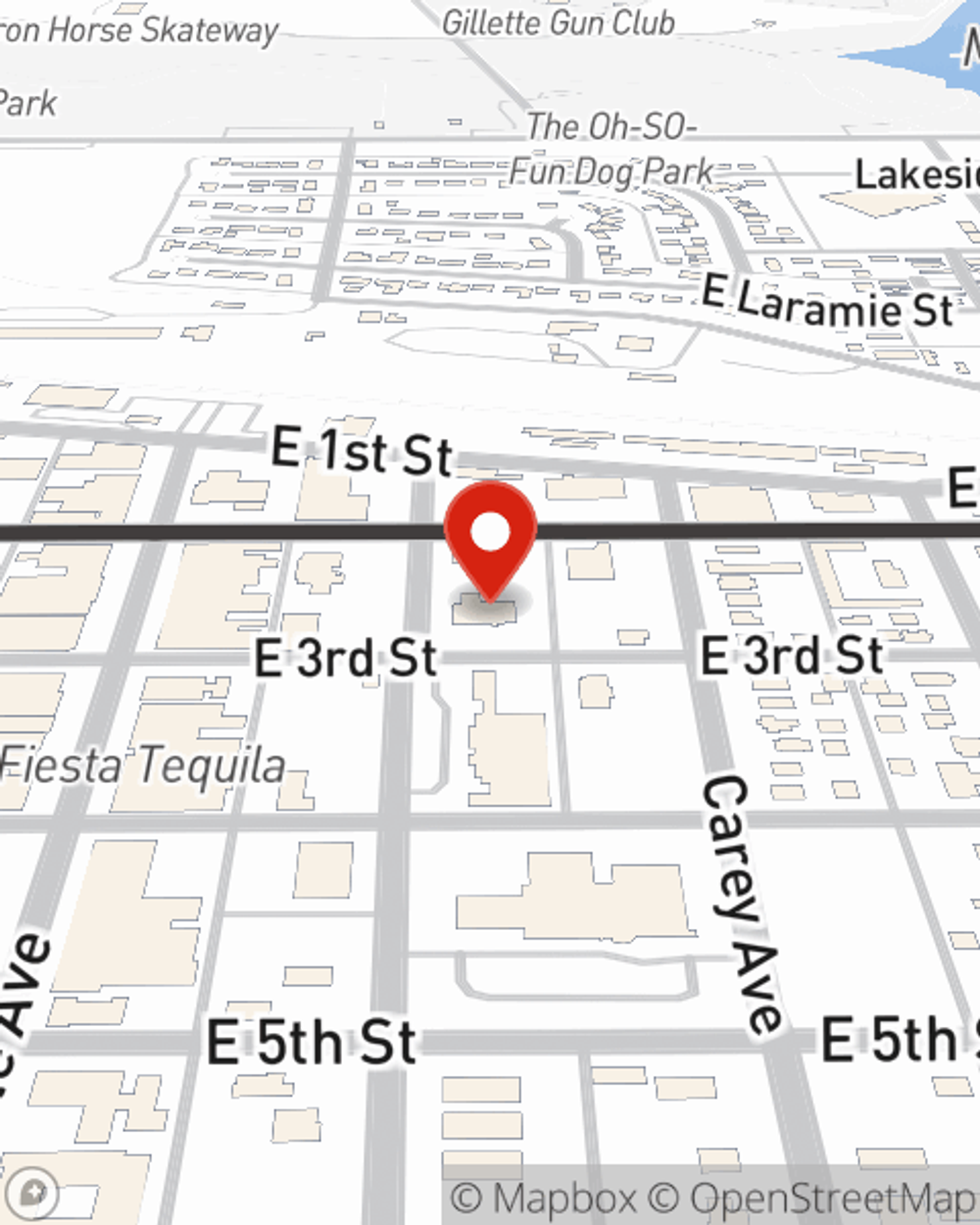

Renters of Gillette, call or email Ida Snead's office to discover your individual options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Ida at (307) 682-3481 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.